Introduction

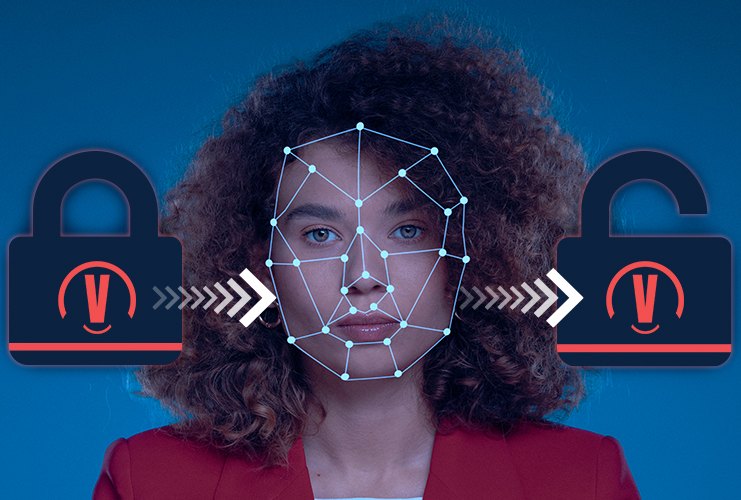

In a world where online frauds are on the rise, it’s never been more important to verify that your customers are who they say they are.

Luckily, advancements in facial recognition software now enable streamlined biometric identification and verification. For you, this means KYC and AML onboarding processes.

Harnessing the power of VeriFace’s online identity verification platform offers your company the chance to deploy biometric facial recognition and strengthen your identity verification processes.

Advanced applications of facial recognition, like VeriFace, can help to identify and verify customers faster and is more cost-effective.

What is biometric facial recognition?

Biometric identification technology encompasses software that identifies persons by their biological characteristics.

Most often, biometric facial recognition is used to automatically recognize a person from their face, a video, or an image. This is usually for biometric identification or verification.

As facial recognition technology scans the patterns in images or faces to find a match, it could be classed as a visual pattern recognition problem.

Using lighting, expressions, and poses, biometric facial recognition can match the visual patterns between the two-dimensional image and the three-dimensional person.

Biometric facial recognition technologies tend to deploy five modules to complete this task: detection, normalization, processing, feature extraction, and matching.

The reason that biometric facial recognition has become such a widely-applicable technology is due to its high accuracy without the intrusiveness of other physiological identification approaches.

Unlike fingerprinting and DNA testing, customers don’t need to be present or to touch anything. Compared to iris scanners, biometric facial recognition can be used from a relative distance.

How does biometric facial recognition work?

Biometric facial recognition technologies work using pattern matching software. Human bodies have ingrained patterns that are unique to each person (fingerprints, ear shapes, hand geometry, and so on).

Facial recognition works by matching the biometric modalities in an image to a person or vice versa, or from an image to another image.

Real-world use cases of biometric facial recognition

As with the case of VeriFace, biometric facial recognition technology is also proving itself as an excellent fraud prevention tool, helping banks and financial institutions to detect fraudsters.

Where previously fraudulent customers would submit false photographs, they must now pass biometric systems. These are much harder to fool.

How is VeriFace using biometric facial recognition?

VeriFace is using biometric facial recognition technology as a way to help companies and financial institutions identify and verify their customers, while also helping those customers identify themselves more easily online.

VeriFace for facial recognition service automatically identifies and verifies customers by matching their image to their official documents and existing databases.

This will highlight any fraudsters, Politically Exposed Persons, or individuals subject to sanctions. This speeds up and cuts costs in your KYC process while ensuring complete AML compliance.

Our biometric facial recognition system is teamed with Optimal Character Recognition and Biometric Liveness Detection.

Not only does this speed up the process of KYC for many companies, but it also enhances precision and removes human error in the identification and verification process.

Conclusion

Harnessing biometric facial recognition tools for identification and verification can help to speed up your KYC processes and ensure that you are up-to-date with AML compliance.

Thankfully, VeriFace’s automated multilayered verification platform provides a biometric identity verification technology that overcomes these challenges.

Combining biometric facial recognition with liveness detection, VeriFace’s identity verification solution offers top-notch accuracy for speedier, more cost-effective verification.

For your company, this means full data security and AML compliance, with sleeker KYC processes. For your customers, this means smoother onboarding and security they can trust.