Stay compliant with global regulatory requirements, manage and mitigate compliance risks and streamline the customer onboarding process.

A comprehensive and flexible solution that can be tailored to your needs.

Stay compliant with global regulatory requirements, manage and mitigate compliance risks and streamline the customer onboarding process.

A comprehensive and flexible solution that can be tailored to your needs.

A flexible and secure VeriFace service that you can easily integrate into your work process.

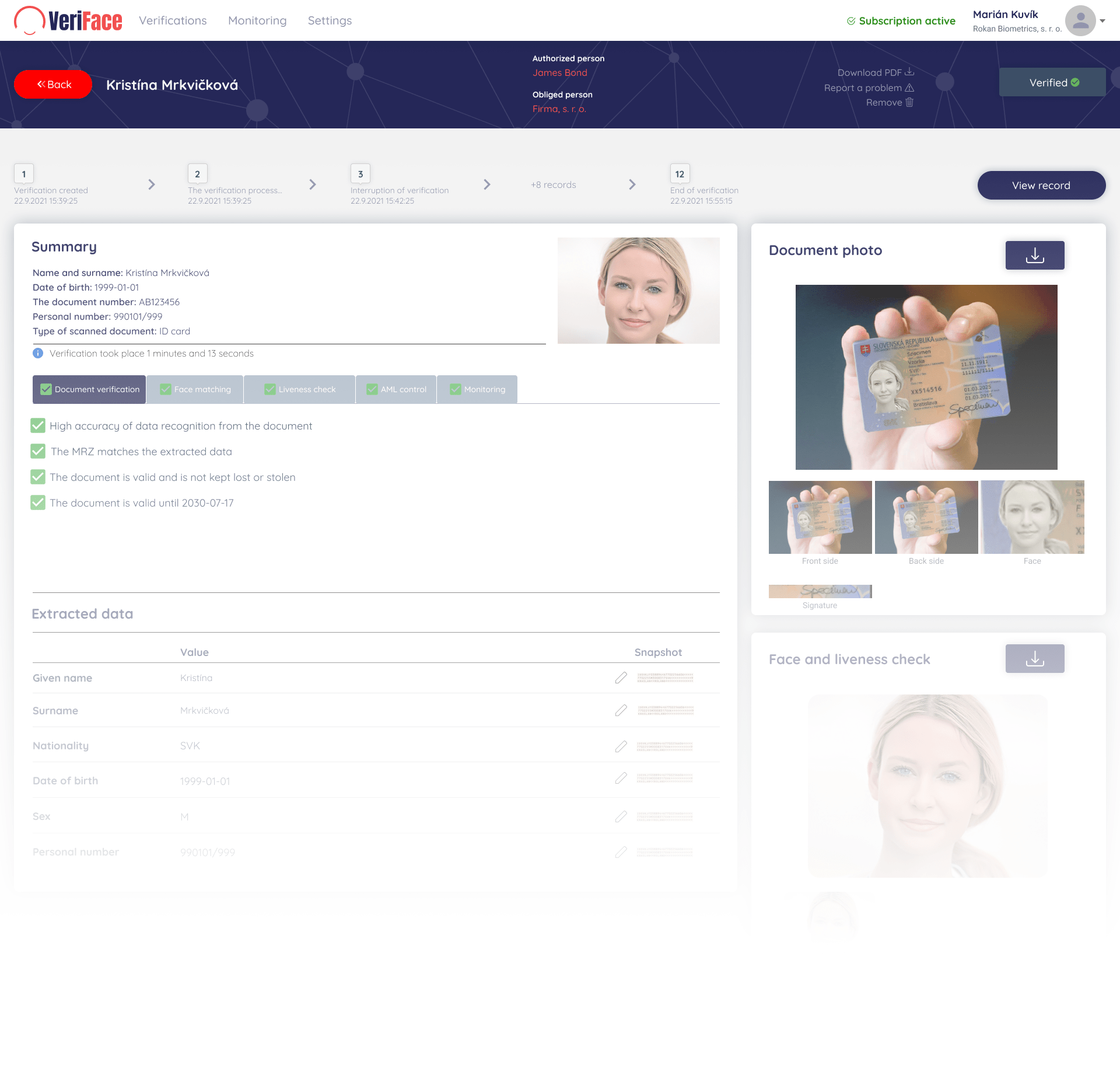

Verify the identity of your customers in seconds to quickly open a customer account and mitigate risk.

Save time and reduce your operating costs.

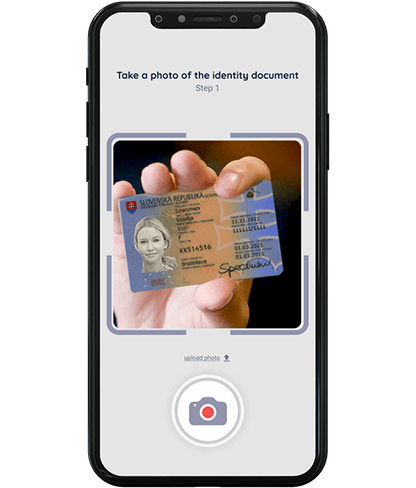

Verify your customers’ identity documents in seconds. Obtain fast and accurate results. Speed up identification and verification of your customers’ identities.

Easily verify your customers’ age, comply with valid regulations and prevent minors from accessing age-restricted products.

Verify your customers’ identities by comparing a face photo from an ID with a real photo of their face and make sure both photos belong to the same person.

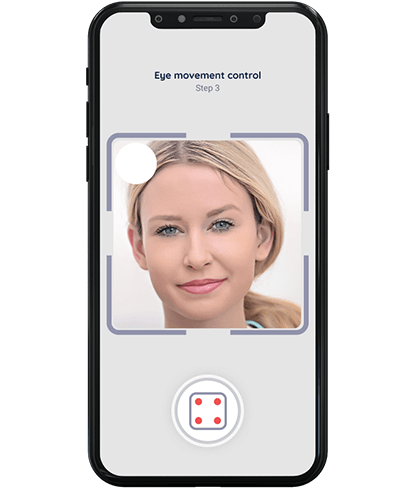

Liveness check ensures that your customers are real and alive by asking them to perform a simple task on a webcam.

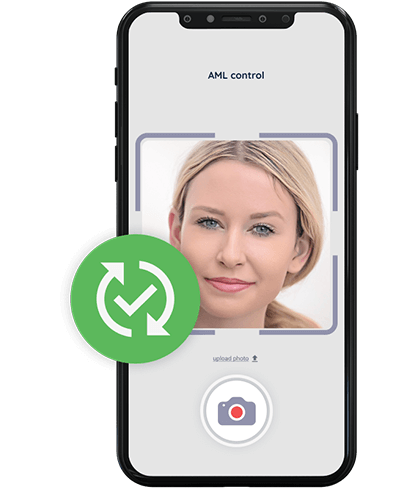

Monitor high-risk individuals for in-depth inspection of your customers. Checks on UBO, PEP and sanctions shall be carried out in order to compare persons with lists of ultimate beneficial owners, politically exposed persons and sanctions.

Regularly monitor your customers. This option allows you to get updates about pre-existing customers if they are added to any list of ultimate beneficial owners, politically exposed persons and sanctions.

Verification and authentication of identity documents in real time and on a large scale.

VeriFace service uses cutting-edge AI technology to verify your customers’ identities.

Our technology compares facial photography from an identity document with a real photo of a customer’s face and makes sure that both photos belong to the same person.

Add an additional level of security to prevent frauds.

Liveness check ensures that your customers are real and alive by asking them to perform a simple task on camera.

By its variability, the liveness check protects against pre-recorded videos by your customers.

Protect your business and reputation with a risk assessment and risk management.

Check your customers’ data worldwide based on over 11 million verified profiles.

A comprehensive service to help you assess and manage risks, perform in-depth checks on your customers and meet the best safety standards.

Monitoring of high-risk persons for the purpose of in-depth control of their customers.

Compliance with global regulatory requirements (FATF, FINMA, FINCEN).

More than 358 document types and more than 93 supported countries.

Automate your processes and save work for your Compliance staff.

AML control is mandatory for financial institutions.

VeriFace service validates customers against all global databases of ultimate beneficial owners, politically exposed persons and sanctions and searches for all mentions in media articles.

Your KYC or Compliance officer can use this information in the decision-making process.

Protect your business and reputation with a risk assessment and risk management.

Check your customers’ data worldwide based on over 11 million verified profiles.

Identify the persons who actually manage or control the firm or asset pooling and for whose benefit they operate. More than 360.000 entities with ongoing updates.

Continuously updated data on PEP and their close persons. More than 1.6 million full and detailed profiles.

Identify people associated with crime, national and global sanctions. More than 800 global consolidated lists (EU, UN, OFAC, HM Treasury, FINRA, Interpol).

Learn more about your customers for better risk assessment and risk management. Millions of reviewed media articles with constantly updated data.

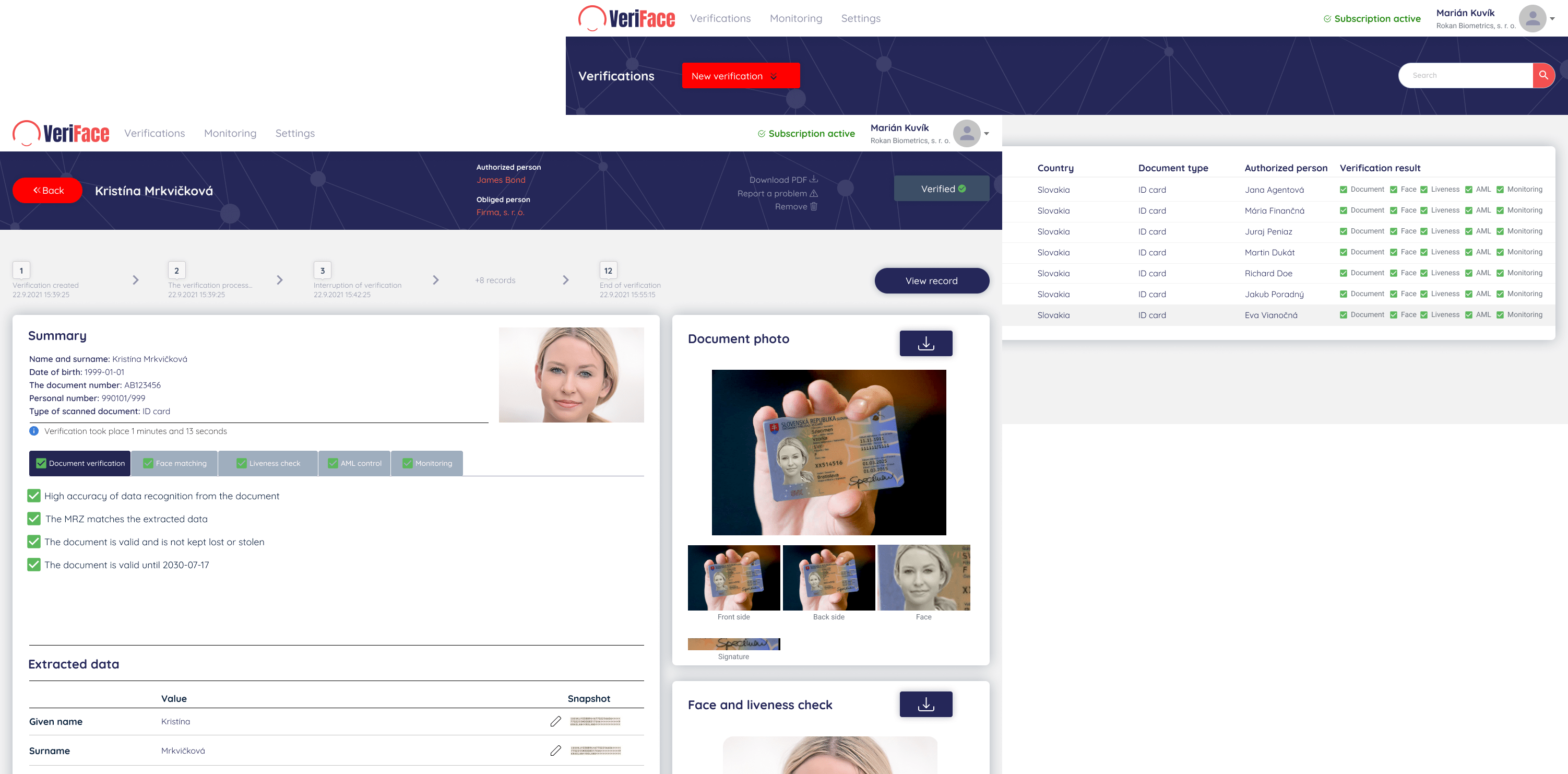

Online service with full access to verification results.

Easy navigation and control KYC processes and customer onboarding in one place.

A wide range of setup and integration options that adapt to your UI/UX interface.

Ready-made solutions for automated customer onboarding with quick setup and easy configuration.

Highly customizable SDK for iOS and Android built on native technologies for seamless integration.

Send a link to customers and check the verification results immediately in the Administrator portal or be informed about them via notifications or Webhook.

Integrate our KYC solutions and customer identity verification into your platform, collect the necessary data, and get API verification results.