- Digital wallets

- Online money transfers

- Crowdfunding platforms

- P2P lending services

- Mobile cash registers

Who is VeriFace for?

Financial technologies

Banking and insurance

- Online banks

- Online insurance companies

- Online exchange offices

- Online stock exchanges

- Online mortgages

Finance, trade and investment

- Securities dealers

- Financial agents and advisers

- Leasing companies

- Investment funds

- Investment marketplaces

Crypto wallets and exchange offices

- Crypto wallets

- Crypto exchange offices

- Crypto funds

- Crypto ATMs

Payments and cash services

- Mobile payments

- Electronic wallets

- Payment institutions

- Payment service providers

Gambling, casinos and stakes

- Online casinos

- Online gambling

- Online bookmakers

- Online slot machines

Hotel and accommodation

- Hotels and pensions

- Accommodation facilities

- Online bookings

Courses and education

- Universities and educational institutions

- Online education (e-learning)

- Online courses and seminars

Telecommunications

- Telecommunications operators

- Point of sale automation

- Online purchase of prepaid SIM cards

Travel and aviation

- Airlines

- Online registrations

- Online ticketing

Healthcare

- Online healthcare

- Telemedicine services

- Online pharmacies and drug prescriptions

Retail and e-commerce

- Online purchases (e-shops)

- Online marketplaces

- Online ordering of goods

Age-restricted products

- Online tobacco shops

- Online liquor stores

- Online adult content

Postal services

- Online electronic services

- Online submission of shipments

- Online money services

Property management

- Access systems

- Owners meetings

Events and activities

- Visitor registrations

- Event reservations

Jobs

- Employee registrations

- Recruitment

Trusted by

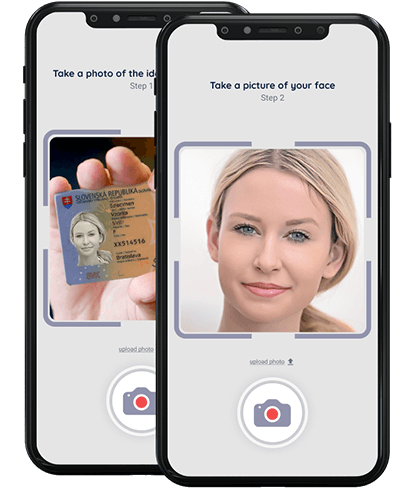

Our user-friendly 2-step identity verification process helps simply, quickly, reliably, and most importantly, securely onboard new customers.

Identity verification

A flexible and secure VeriFace service that you can easily integrate into your work process.

Verify the identity of your customers in seconds to quickly open a customer account and mitigate risk.

You save time and reduce your operating costs.

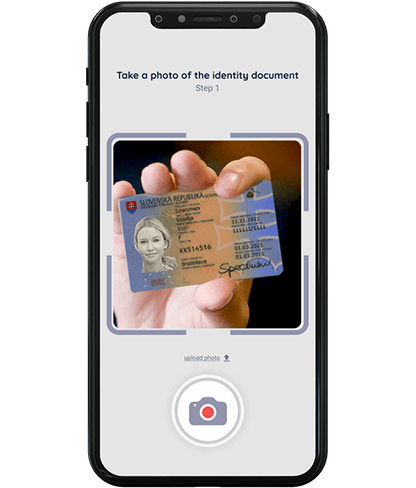

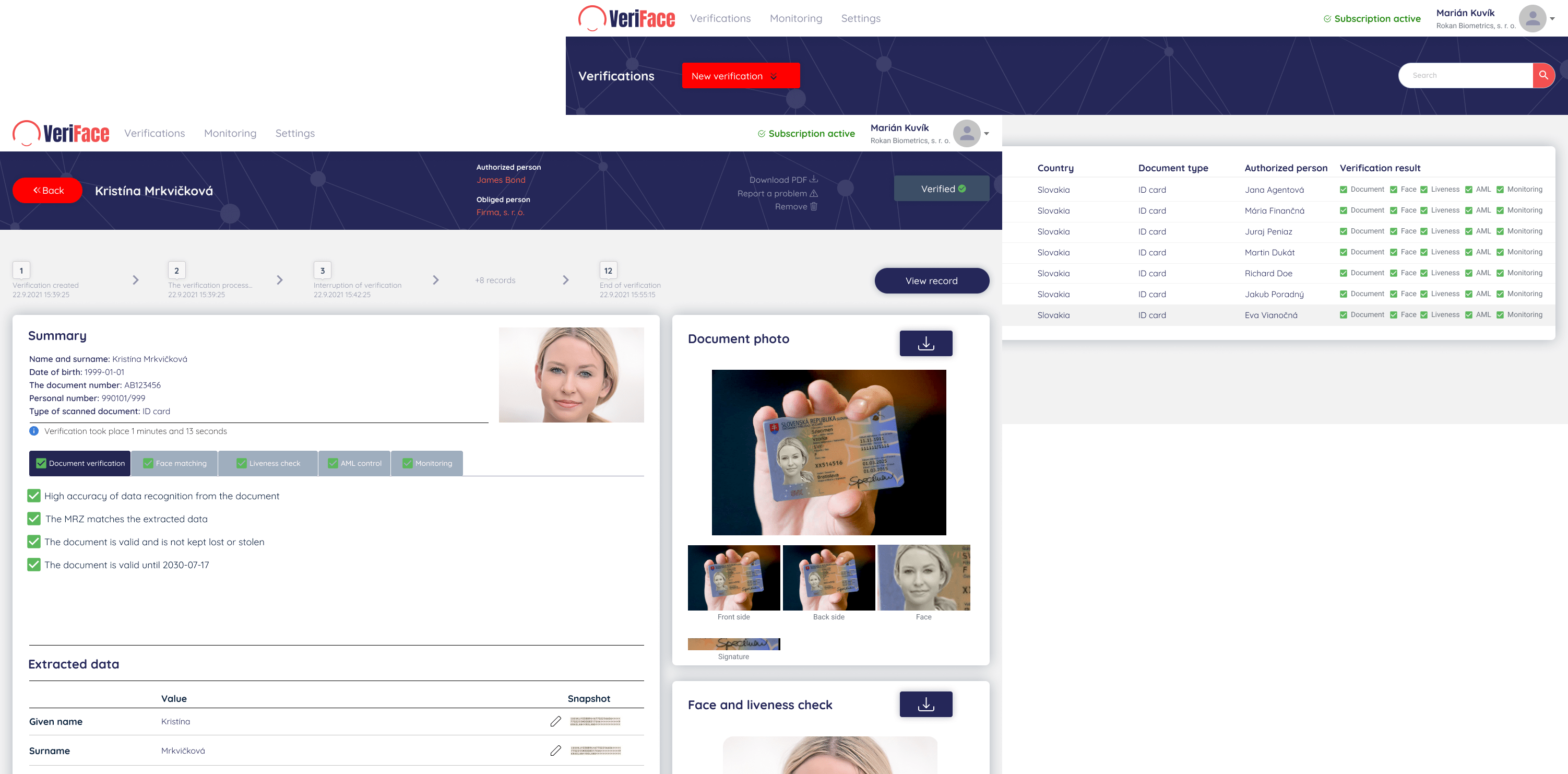

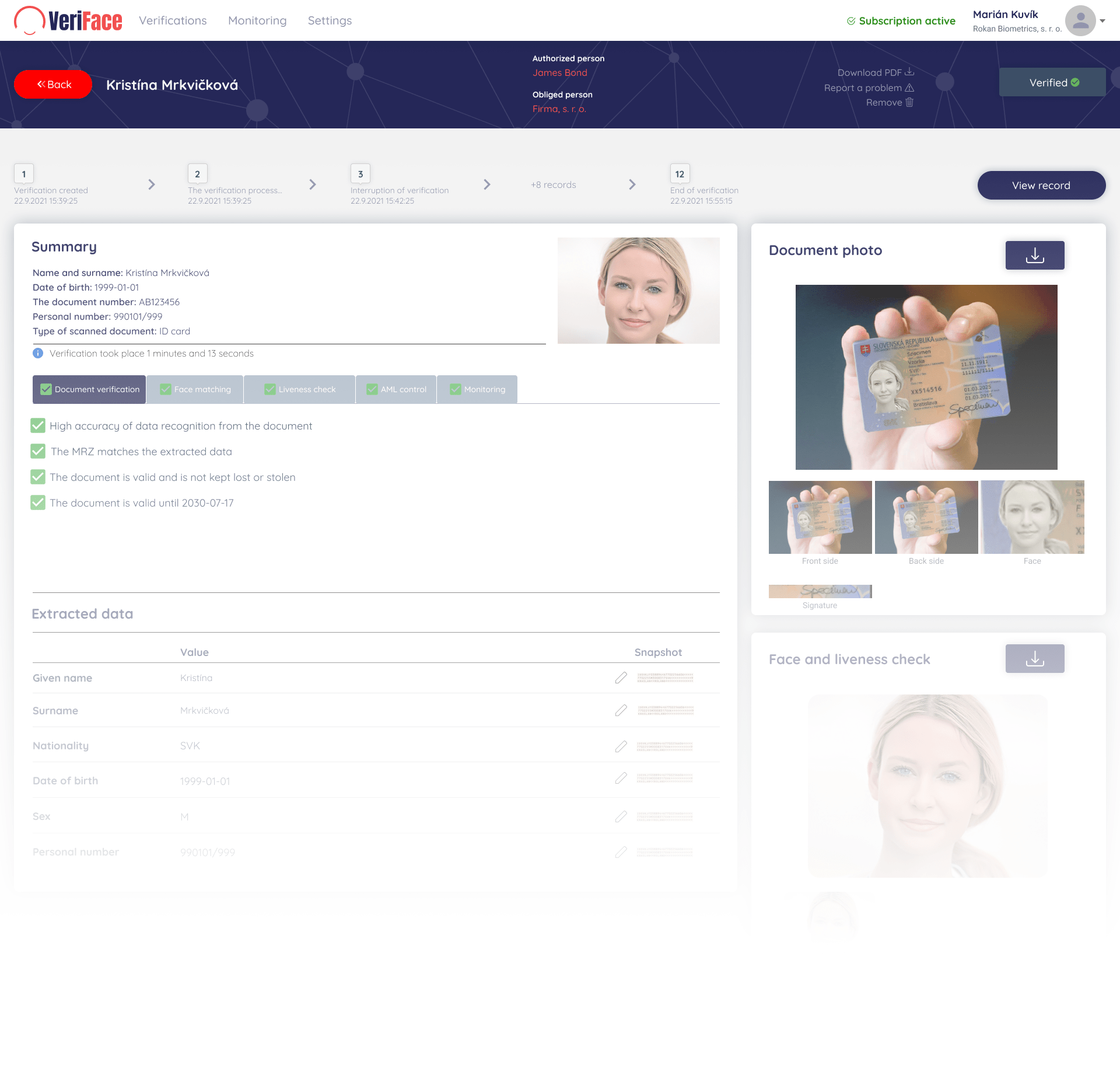

Verification of identity documents

Verification and authentication of identity documents in real time and on a large scale.

- Extracting data from identity documents

- Check the validity of identity documents

- Verification of the number and series of identity documents

- Verification of face photos from identity documents

- Verification of a person’s age

Face matching

VeriFace service uses cutting-edge AI technology to verify your customers’ identities.

Our technology compares facial photography from an identity document with a real photo of a customer’s face and makes sure that both photos belong to the same person.

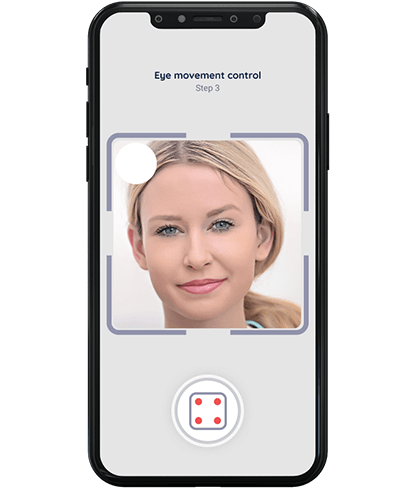

Liveness check

Add an additional level of security to prevent frauds.

Liveness check ensures that your customers are real and alive by asking them to perform a simple task on camera.

By its variability, the liveness check protects against pre-recorded videos by your customers.

AML control

Protect your business and reputation with a risk assessment and risk management.

Check your customers’ data worldwide based on more than 1.6 million verified profiles.

- Ultimate beneficial owners

- Politically exposed persons

- Sanctioned persons

- Media personality image

- Regularly monitored data

- Global coverage

- Continuously updated data

Administrative portal

Online service with full access to verification results.

Easy navigation and control of KYC processes and customer onboarding in one place.

- Detailed view of verification results

- Secure storage of customer data

- Fully compliant with GDPR

- Real-time updates

- Verification status history

Seamless integration with your corporate ecosystem

A wide range of setup and integration options that adapt to your UI/UX interface.

- Web SDK

Ready-made solutions for automated customer onboarding with quick setup and easy configuration.

- Mobile SDK

Highly customizable SDK for iOS and Android built on native technologies for seamless integration.

- Cloud verification page

Send a link to customers and check the verification results immediately in the Administrator portal or be informed about them via notifications or Webhook.

- API integration

Integrate our KYC solutions and customer identity verification into your platform, collect the necessary data, and get API verification results.