Fast, secure and reliable identity verification remotely using facial biometrics

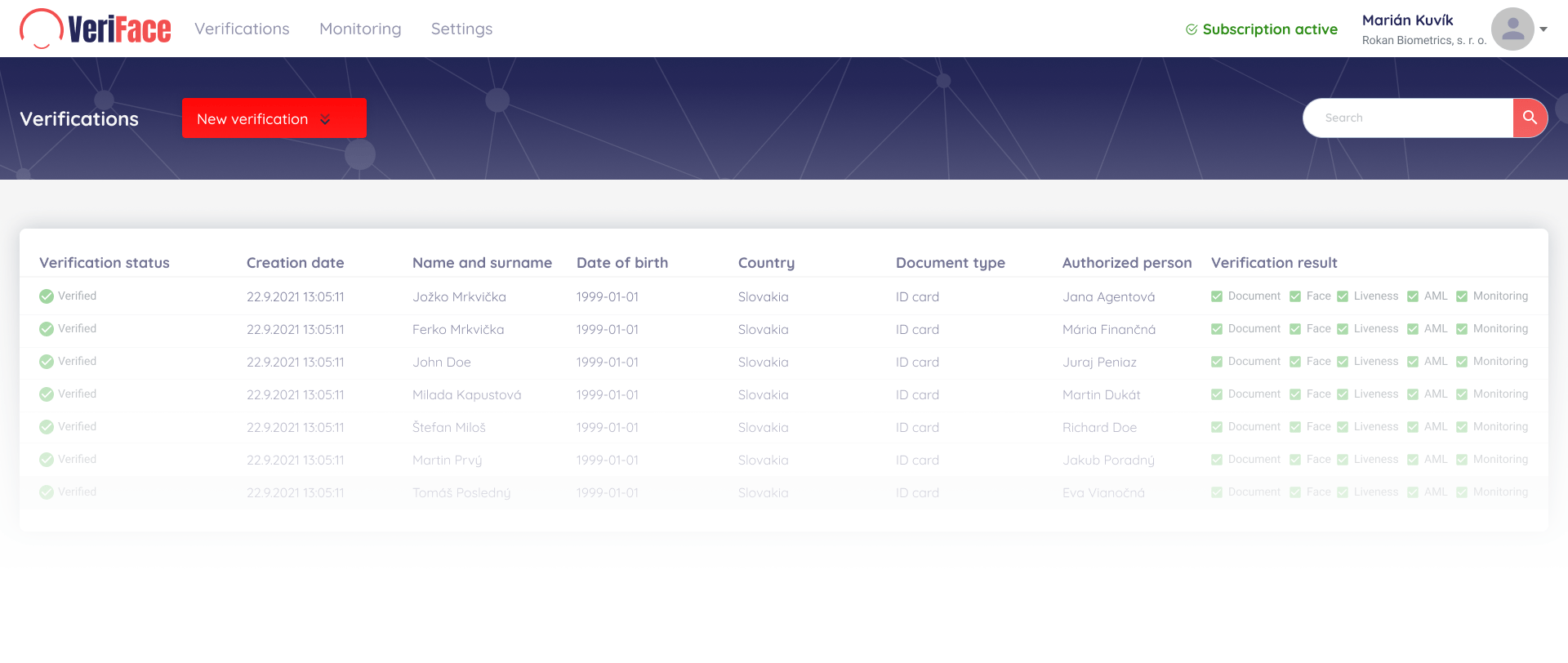

VeriFace is a comprehensive remote identity verification service that streamlines the customers onboarding process, ensures full compliance and reduces numbers of frauds.

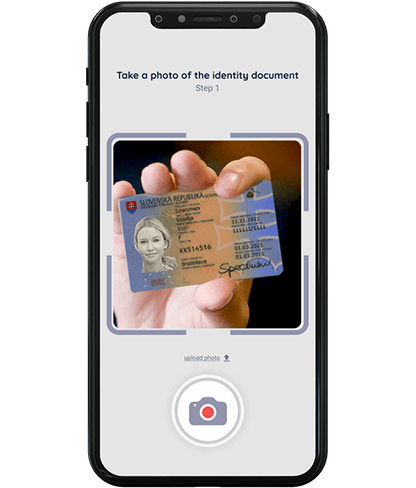

- Document verification

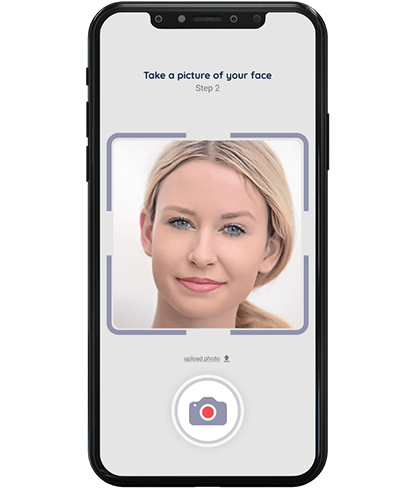

- Face matching

- Liveness check

- AML control (UBO, PEP, Sanctions)

- Age verification

- Regular monitoring